Ethical Buying

Introduction

Consumers are increasingly aware of the provenance of the good and services they consume and want to know if these have come at an unacceptable cost to others. The transparency and availability of information via the internet and particularly social media means companies must have confidence in their supply chains and the statements they make about their products. Word of mouth spreads incredibly quickly among consumers, and it is extremely difficult to counter an online firestorm. This is a major risk that any company, whether they are a supplier or a producer of end products, should be continually addressing and monitoring.

What is ethical buying?

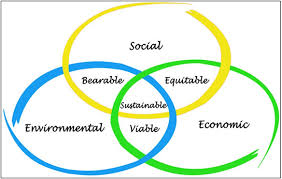

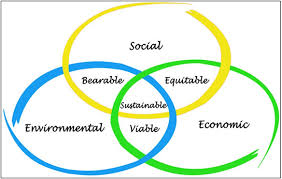

Essentially, it is about ensuring that the products and services a company purchases do not cause undue harm or risk for people, animals, or the environment. It overlaps with sustainability, since buying products which cause harm to the environment, via production methods, excessive freight, and haulage, or use of non-recyclable materials could be unethical. It also includes people – no forced or child labour in the supply chain, fair wages and a safe hygienic operating environment for workers; animals – such as farming and testing practices; and even politics – avoiding purchase from certain regimes such as Myanmar and Zimbabwe.

There are generally three types of ethical buying practices, which procurement professionals can use in combination:

- Positive buying: actively selecting products that are ethically produced, to avoid harm to the environment, such as locally grown foods, energy-saving lightbulbs, or electric cars

- Avoiding negative buying: avoiding, as a policy, the purchase of items which do not meet ethical criteria, such as cosmetics tested on animals, or from factories which fail to provide adequate working conditions.

- Company selection: avoiding or favouring suppliers based on their ethical standpoint and standards. This could include not purchasing fuels from companies which have caused environmental damage in sensitive regions such as rainforests and the Arctic

Ethics and cost control are not mutually exclusive! Ethically produced products and services can avoid the need for expensive redress and can also produce higher quality which reduces wastage and improves efficiency. Suppliers will increasingly need to meet and guarantee standards to win contracts with consumer-facing organisations, and it is more efficient to apply these company-wide, rather than have different terms for different customers.

The FAIRTRADE Industry is having a direct impact on the living conditions of approximately seven million people in rural areas in the developing world.

Why

Social Procurement creating a benefit beyond the purchase of goods and services which enables buyers to support local economies have a positive impact on the environment, create more jobs and increase employee wellbeing

- Making a positive social impact.

- Resource Positive-Give more than you take.

Ethical buying is that ethically produced and sourced products are valued by consumers. According to the 2019 PWC Irish Retail Consumer Report, 41% of Irish consumers are prepared to pay a premium for sustainable products, and 68% are prepared to pay a premium for locally produced food:

“Organisations who are able to consistently and transparently demonstrate their alignment with their customers’ values and beliefs have an additional advantage when it comes to where spend is directed, and how trust and loyalty are earned.”

Consumers increasingly correlate ethical production with higher quality, particularly younger people who are particularly conscious of their lifestyle choices and enjoy sharing these online. Unethical practices within the supply chain present a big risk for any business. Just look at recent examples of modern slavery conditions in Leicester’s clothing factories, that were widely reported as being Boohoo’s own workers, whilst they actually worked for a supplier. However, it wasn’t enough for Boohoo to claim innocence just because they didn’t own the factories.

We live in a fickle world, and globalisation has intensified competition. Ethical buying presents an opportunity for companies to differentiate themselves and meet customers’ needs. This isn’t important only for end-user companies though – for an end product to be sustainable and ethical, all its’ input processes and components have to meet the same standards. This is where the supply chain becomes so important. Can customers really be expected to pay a premium for “locally produced” food products if thousands of air miles have gone into the ingredients?! Therefore, as mentioned above, companies within a supply chain may find that ethical sourcing practices help to win more business and more customers.

How?

Ethical buying might seem like a minefield, and yet another thing to consider when making purchasing decisions. But it’s nothing compared to the extra work, costs and headaches that result if a company is found to breach acceptable standards, or to have been misleading (or even untruthful) about its’ products. It could also be argued that this is the minimum that any responsible organisation should be doing.

Ethical buying practices shouldn’t be difficult or cause extra hassle. Here are a few hints and tips:

- Use standards – other people have already done the hard work for you, and lots of standards are available, which can only be used if the producer or supplier meets certain objective standards. These include: Rainforest Alliance, Fairtrade, Organic, the Ethical Trading Initiative, Red Tractor, Soil Association – there is a long list, so the key is to find the right one for the circumstances. These are easier for buyers than developing specific standards, and it is far simpler for suppliers to have one common standard for all customers. It’s worth mentioning that different laws and standards apply in different countries, so a supplier simply operating within the law might not be enough.

- Get to know your suppliers and ask the awkward questions! If something seems too good (or too cheap) to be true, then it probably is. You can take this a step further and establish formalised supplier evaluation procedures such as scorecards. These are helpful for organisations with large procurement teams, to make clear to buyers what’s important as well as price, e.g. factory standards, transportation distance, codes of conduct and standards.

- Internal practices – of course, it is also important that your own procedures do not contribute to or even encourage adoption of unethical practices. For example, late ordering can put pressure on workers’ hours, and overly aggressive price negotiation (especially by dominant customers) can push down wages. Too often, buyers turn a blind eye due to pressure to meet cost and margin targets. Set standards within your organisation, make them public and stick to them.

It is no longer enough not to know what is happening within your supply chains. Arvo’s procurement specialists can assist you to review your supply chain to find potential risks, and opportunities to embrace ethical buying, and the advantages it can bring

Author: Kate Sherry

Arvo have been supporting public bodies with public procurement compliance, efficiencies and effectiveness for many years now and we are regularly asked –

Arvo have been supporting public bodies with public procurement compliance, efficiencies and effectiveness for many years now and we are regularly asked –